https://www.99.co/blog/singapore/dee...operty-market/

How a deep recession could impact the property market in Singapore

1 week ago ∑ 9 min read ∑ by Kyle Leung

As the world continues to reel from the economic effects of Covid-19, the official outlook for Singaporeís Gross Domestic Product (GDP) in 2020 was downgraded yet againófrom -1 to -4% to -4 to 7%óon 26 May, signalling the deepest recession the country has ever faced since independence.

The GDP is the total value of goods and services produced by a countryís economy during a specified period of time (i.e. one calendar year). A negative GDP figure indicates an economic recession.

To put things in context, Singapore has never had itís GDP shrink by more than -3.1% in the span of a year. That was way back in 1964.

The last time Singapore recorded a full-year contraction was during the dot-com bust in 2001, when growth fell by 1.1%. The countryís worst post-independence recession occured during the Asian financial crisis in 1997-98, when GDP fell by 2.2%.

Asia will also experience zero economic growth in 2020, according to the International Monetary Fund. This will be the continentís worst GDP performance in 60 years.

How will a -7% GDP contraction affect the property market?

On the same day that the Ministry of Trade and Industry (MTI) issued the revised GDP outlook, the Singapore government took another step to protect jobs and shore up the economy with the $33 billion Fortitude Budgetóthe fourth budget of 2020.

In total, the government will draw on past reserves and spend an unprecedented $92.9 billion dollars on the economy, amounting to nearly 20% of a yearís GDP.

Announcing the supplementary budget, Deputy Prime Minister Heng Swee Keat warned that Singapore ďmust be prepared for tough times aheadĒ, and that it may take up to 18 months for a Covid-19 vaccine to materialise.

In the meantime, the country will have to adjust to a new normal.

But how will the Singapore property market fare amid an unprecented recession? Letís start with the basics:

Iím a property buyer. What will a deep recession mean for me?

The good news first. In the current situation, buyers who are in very secure jobs (e.g. civil service, healthcare) are actually in relatively better position because the overall market is showing some signs of weakness. Buyers also get to enjoy bargain basement home loan interest rates right now.

Simple economics state that lower demand means lower prices, given that supply doesnít also decrease. Covid-19 will certainly take out a group of buyers: those adopting a wait-and-see approach or who are simply unable to buy due to reduced income. The lack of competing buyers will put you in pole position to negotiate, even when it comes to units and developments with superior attributes.

Donít wait too long, however, if youíve already shortlisted some potential properties. Take newly launched condos as an example, collectively thereís definitely a supply glut, but there are still a finite number of choice units that will be quickly taken up by opportunistic buyers in a similar position as you.

If youíre somewhat impacted (e.g. income slightly reduced) but still need a home, consider reducing your budget proportionately and keep the following tips in mind:

Consider keeping the cost of the home to five times (5x) the combined annual household income (e.g. you and your spouse)

For the above, use a conservative version of your income (i.e your pay before your latest promotion) to calculate

Avoid maxing out your Total Debt Servicing Ratio (TDSR), which could be the case if you are also servicing a car loan

Make sure you have six months worth of emergency savings after making the downpayment

In any case, always seek a financial consultantís advice before committing to the option fee/downpayment for a new home, and a property agentís advice for more affordable options that still fit your needs and preferences. 99.coís comprehensive search filters will also help.

Be prudent when buying a home during a recession.

Iím a property seller. What will a deep recession mean for me?

Honestly, even if in-person viewings resume, youíre going to find that it takes longer to sell a property. The typical three months to find a buyer will likely turn into six months, for instance.

So, factor the extended timeline into consideration and set realistic asking prices, even if you have holding power. For example, if you have an offer thatís 5% lower than your intended price but still nets you a profit, consider accepting it rather than holding out for a better offer, which may not materialise since thereís a good chance the market might soften further in the next few quarters.

If youíre facing temporary financial constraints, you may also want to considering deferring your mortgage, or renting out part of your property (i.e. the master bedroom), instead of selling and downgrading. Speak to your financial advisor to explore the feasibility of each option.

Do be very careful when selling your property, to avoid making a negative sale that could further worsen your financial situation.

Iím a property investor. What will a deep recession mean for me?

If youíre dependant on rental yields, youíll need to tread carefully. Considering that the governmentís supplementary budgets benefit mostly Singaporeans, itís likely that weíre going to see a fair number of expats with pay cuts during this recession, with some even getting retrenched. Rental demand, especially for more expensive Core Central Region properties, will fall along with rents. (Expats are already asking for rent cuts, by the way.)

Tread carefully when buying prime district condos for rental yield.

Comparatively, properties outside of the city may start to look more attractive to the property investor, as do leasehold developments with a low entry price. The recession may also prompt some HDB owners to upgrade, moving to a low-priced condo while unlocking the rental potential of their existing HDB flats (especially if the flats are in a highly rentable location).

Perhaps more than at any point in time, itís looking more attractive to own and rent out properties to workers in essential industries and sectors, rather than office-bound expats, and these are homes that are typically further out from the CBD and near to catchment areas such as major industrial estates, hospitals and universities.

But thatís not to say that itís game over for prime district homes. In April, we saw a Chinese billionaire splash $28 million on a penthouse near Orchard. The volume of such high-value purchases are going to fall in a recession, but theyíll still happen as long as these homes continue to be viewed as safe haven assets among ďbuy-and-holdĒ investors.

Just how much will property prices fall?

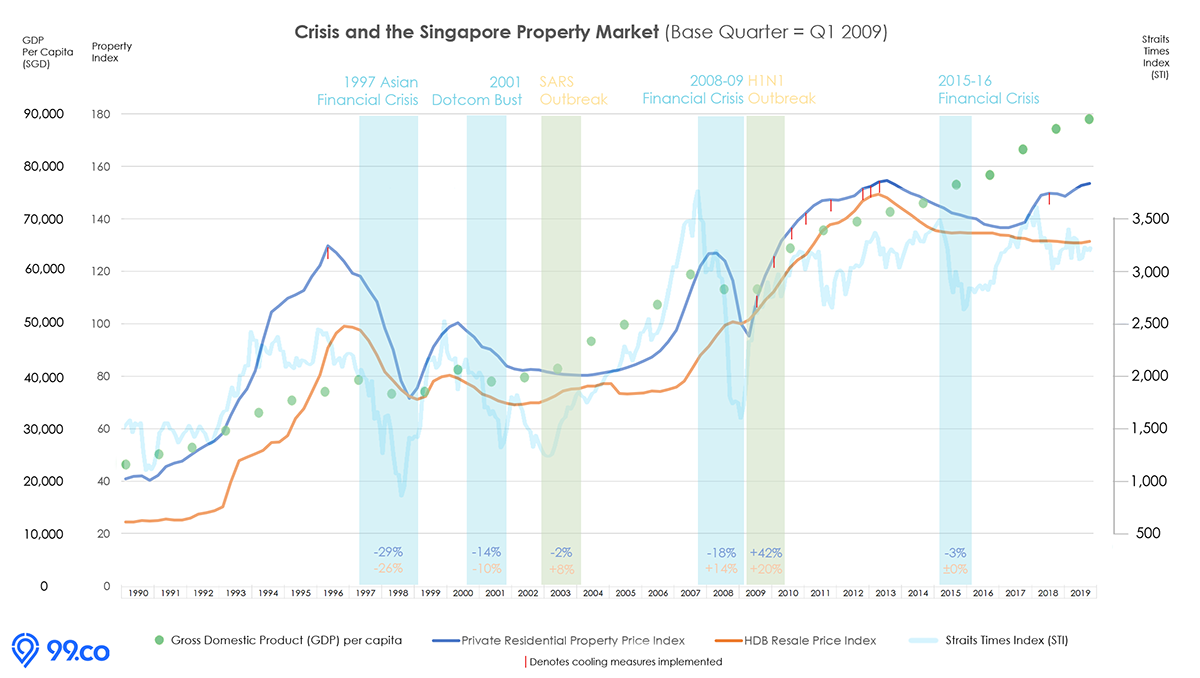

To get an idea of just how much property prices might fall in this recession, letís look at this chart:

(Click/tap to enlarge the chart.)

From the 30-year chart above, we can see that the indicator that correlates the most with falling private property prices is the Gross Domestic Product (GDP) per capita, which is essentially GDP divided by the population of an economy.

HDB resale prices, on the other hand, do not seem to have a clear correlation with any particular indicator. However, itís noteworthy that in the worst crisis the chart illustrates (the 1997-98 Asian Financial Crisis), HDB and private home prices plunged in tandem.

In a recession, the GDP per capita typically falls by more than the GDP. Thatís because the population of an economy/country tends to increase year-on-year, resulting in a lower GDP per capita in a situation where GDP is unchanged (i.e. 0% change).

And the chart shows that, whenever GDP per capita fell, prices of private property in Singapore fell as well.

In the past 30 years, there were three dips in GDP per capita: in 1998, 2001 and 2008-2009. In all three instances, the URA Private Residential Price Index fell. The Index (i.e. private home prices) fell a staggering -29% during the 1997-98 Asian Financial Crisis.

In the dot-com bust of 2001, private home prices fell by 14%. During the 2008-09 Global Financial Crisis, private home prices fell by 18%.

With GDP per capita again expected to drop this year with the GDP, will we again see a double-digit drop in private home prices?

Yes and no. Yes because thatís what history has told us will happen, but no because of the following three reasons:

Firstly, successive cooling measures over the years have prevented the private property market from runaway price growth, so the magnitude of any fall will likely be lower than 1997-98, 2001 and 2008-09.

Secondly, the crisis of 1997-98 and 2008-09 were crises driven largely by real estate bubbles, whereas the current crisis is driven by a pandemic. Property watchers will take comfort in knowing that both private and HDB property prices performed robustly during the SARS and H1N1 outbreak, as the chart above shows. (Then again, none of these outbreaks had led to a full-blown global recession.)

Thirdly, the Singapore government has introduced a slew of policies and legislation that appears specifically intended to avert a plunge in property prices (in addition to wider policies that benefit households and secure jobs):

Allowing homeowners to defer their home loan repayments for the full year

Protecting deposits paid by property buyers to developers

Extending the ABSD remission timeline from six to twelve months, benefitting both homebuyers and developers

If deemed necessary, we believe that the government will come up with further interventions to cushion the fall of property prices during this seriously-deep recession.

So, hereís our take on the effect of a -4 to -7% recession on the property market in Singapore:

Private property market: Following a 1.2% price fall in Q1 2020, a further 5 to 11% decrease in home prices in 2020. High-end, luxury residential properties will likely experience greater downward price pressure.

HDB resale market: A fall, but by a lower magnitude compared to the private property market. (HDB prices were unchanged in the first quarter of 2020.)

Reply With Quote

Reply With Quote