Monday, Aug 15, 2016

Dollars and Sense

According to Urban Redevelopment Authority's (URA) published private residential property index, prices have dropped by more than nine per cent since its peak in June 2016.

So the big question mark is whether we should still choose HDB/EC over a private property.

As private properties are expected to continue its downward trajectory, it makes them more attractive as time goes by. If we are thinking of jumping on the private property bandwagon, these are a few things we will lose.

Housing grants

By buying a private property, we are basically telling the government that we are willing to forfeit our birthright to housing grants for HDB and Executive Condominiums (EC).

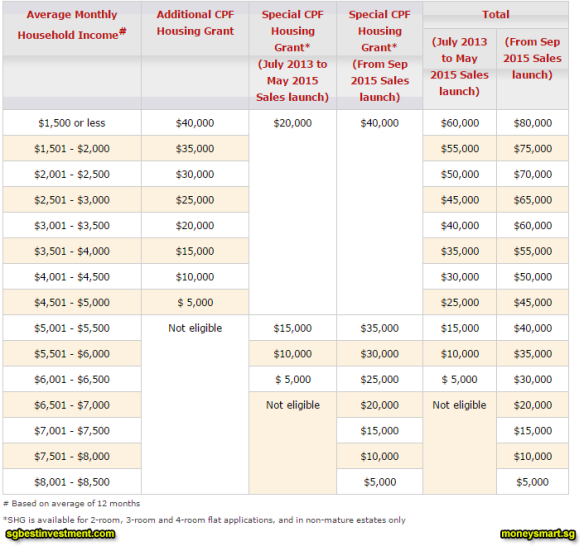

For HDBs, there are generally two kinds of grants that we can obtain. The Additional Housing Grant (AHG) and Special Housing Grant (SHG). Each of these grants has a cap at $40,000. Therefore, the maximum grant one can receive is $80,000.

For those who intend to purchase ECs, there are grants for them as well. It is called the Family Grant and the Half-Housing Grant. These grants have a cap of $30,000.

Potential earnings from price differential

We will refer to properties according to their number of bedrooms - therefore HDB 4-room is referred to as 3-bedroom.

A typical 3-bedroom HDB in a mature estate would cost $440,000, while a 3-bedroom condominium would cost about $1,500,000. That would mean a difference of $1,060,000.

Of course, we will not be able to invest this $1.06 million and earn something right away. However, incrementally every month, those who bought a private condo will have to fork out a higher mortgage repayment amount. This amount can be invested into other instruments (e.g. equity funds) that are more liquid and may provide a better return in the long term, compared to holding on to property in an already developed nation.

Higher interest payments

As private properties are more expensive, we would require a larger sum to finance the big-ticket purchase. As we all know, the more we borrow, the more interest we need to pay.

With an additional $1.06 million more, the overall interest payments will be considered as amounts that you have "lost" to the banks.

As long as our household earns less than $14,000/month in total, it would always be wiser to use our birthright to purchase a public housing.

Even if we have a load of cash, it would still be wiser to have more of them being liquid so that we can allocate them more easily, rather than have it stuck in a property.

http://business.asiaone.com/property...ty-instead-hdb

Reply With Quote

Reply With Quote