Recovery, MTB please take note. 8 month after TDSR and with 8 CM to control the market, money print is is on.

Recovery, MTB please take note. 8 month after TDSR and with 8 CM to control the market, money print is is on.

Recovery too. Now, even if demand is lacking ....land price and building cost cannot get any lower. Smart money are busy investing in OZ where restriction is low.

HDB BTO price increase 14%, but resale dropped 5%?

Posted on July 20th, 2014 under Articles, HDB 0

4-room BTO flat price increased 14.4%?

HDB has just launched BTO flats in the mature estate of Toa Payoh, with 4 – room prices starring from $413,000.

http://www.hdb.gov.sg/fi10/fi10296p....E?OpenDocument

In the November 2012 Toa Payoh Crest BTO, 4 – room prices were from $361,000.

http://esales.hdb.gov.sg/hdbvsf/eampu11p.nsf/0/12NOVBTO_page_8931/$file/12NOVBTO_about0.htm

This is an increase of 14.4%.

But Resale Price Index decreased 5.1%?

The HDB Resale Price Index http://www.hdb.gov.sg/fi10/fi10321p....x?OpenDocument

has dropped by about 5.1% from 206.6 in the 2nd quarter of 2013 to 196.0 (2nd quarter 2014), and about 3.4% from 202.9 to 196.0 from the 4th quarter of 2012 to the 2nd quarter of 2014.

So, if the Resale Price Index dropped by 3.4%, why did the price increase by 14.4%?

BTO prices delinked from resale prices?

It may be bad enough that in the past, we were told for years that HDB BTO prices were pegged to resale prices, and then recently that they have been delinked – only now to appear as a if they increase much more when resale prices dropped quite a lot in the same estate.

Transparency and accountability please?

Can we have more transparency and accountability as to how HDB flats’ prices are determined.

Land costs 60%?

Is it about 60% of the price is allocated to land costs?

HDB lose billions every year?

How much profits has the HDB been making all these years?

Govt not spending a single cent on HDB?

Is the Government still not spending a single cent on public housing (HDB) as it makes profits from the sale of HDB flats?

S Y Lee and Leong Sze Hian

P.S. Come with your family and friends to the 3rd Return Our CPF – HDB protest on 23 August 4 pm to 6.30 pm at Speakers’ Corner https://www.facebook.com/events/648543138548193/

Remember the cash out is for all investment except property. After you cash out, who know what you do to the money???

That is the reason for the TDSR.

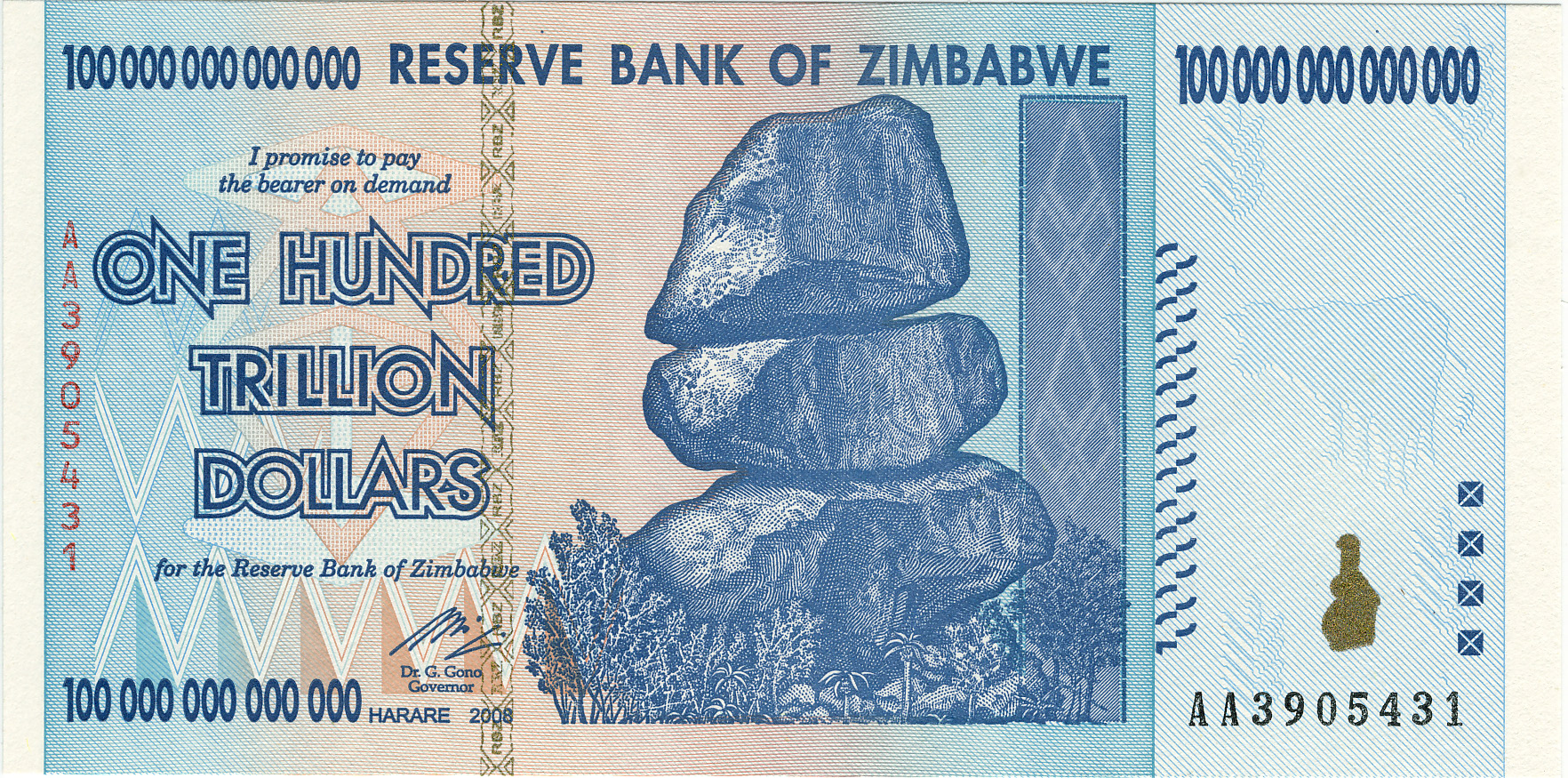

Money itself have no value, it is the thinking of being able to exchange the money for something that create the value.

What is the price of Gold? It is when you think you can sell the Gold at a certain price. If nobody buy gold, gold is just a piece of metal call gold.

Money by itself got no value, it is just a piece of IOU. The more IOU, the value decrease.

What is the value of GOLD? Gold is just a piece of metal and the value is what people would like to pay to have it.

http://www.peakprosperity.com/crashc...money-creation

Now, where did this money come from? Glad you asked. It comes out of thin air, as the Fed creates money when it ‘buys’ this debt. New Fed money is always exchanged for debt, so we can now put the title on this page.

Don’t believe me? Here’s a quote from a Federal Reserve publication entitled “Putting it Simply:” "When you or I write a check, there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check, there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.

1997 I went to Italy, I cannot use SGD to change to LIRA, I need to change to USD than to LIRA. If you got lot of SGD in Italy than you just have LOT of pieces of printed paper.

What can you buy with this.

Last edited by Arcachon; 16-09-14 at 16:38.

Thanks. No wonder investors are exchanging valueless paper for physical commodities.

However Singapore government is not exactly printing money. Hence I wonder the extent of influence.

Every Central Bank print money, the different is how much and how fast.

http://www.tradingeconomics.com/sing...oney-supply-m3

1 million Condo at 4 per cent CPI what is the value after 1 year. SGD 40,000.

1 million Condo do you pay 1 million.

The CPI is an annual gauge of how much the prices of goods have risen. So a CPI of 4% means that, over the year, the prices of everything went up by 4%. That’s why a cup of kopi cost your grandma about a cent, and costs you around $1.20.

http://blog.moneysmart.sg/career/5-d...reans-believe/

3. Saving Money Alone is Enough

Milo tin

The good news is grandpa stashed his life savings in this Milo tin. The bad news is it’s now worth less than the tin.

To understand why we no longer stuff money into Milo tins, let’s look at something called the Consumer Price Index (CPI).

The CPI is an annual gauge of how much the prices of goods have risen. So a CPI of 4% means that, over the year, the prices of everything went up by 4%. That’s why a cup of kopi cost your grandma about a cent, and costs you around $1.20.

Now, grab your wallet and check the dollar bills. You will notice that, despite the prices of everything going up, the numbers on those dollar bills are not changing to compensate.

In effect, the money you have is worth 4% less. And every year, Singapore’s CPI reaches around 3% to 4%. Over the course of 20 to 30 years, you can expect inflation (the CPI) to utterly destroy your wealth if all you do is save.

In order to be safe, you should aim to beat the CPI by 2%. So you need to invest the money, and fetch returns of about 5% to 7%. There are plenty of ways to do this, from insurance policies to ST Index funds. You can check out investment basics in our other article.

And incidentally, the cost to get started can be as low as $100 a month. (Try POSB, OCBC or Philip Securities)

Last edited by Arcachon; 16-09-14 at 19:48.

Never trust the paper money that can print easily like no tomorrow, own phyiscal assets that cannot be printed better...

Obviously, there will bound to be policies to deter you and me from doing that because of some reasonssss..., but following those advocation is really detrimental to us.............!!!

Printing the money is similar to writing a cheque. For example I write 2 cheque worth 1000 dollar each for my worker, because his salary is 2000 a month. Every month he cash in his 1000 dollar to pay for his necessities and keep the other 1000 dollar cheque for saving. Instead of keeping the cheque to himself, I offer him to hand in the 1000 dollar cheque back to me in return for a 10% interest. Therefore I can use the same 1000 dollar cheque to pay for my next worker.

My cheque is only as good as my bank balance. If all my workers decide to cash in all their cheque I won't have enough balance in my bank.

To answer your question: what happen if I stop writing cheque (ie. Printing money)? My cheque wiil still bounce if more people are cashing in (because there were never enough balance in the bank in the first place).

Saving cash in the bank is constitute having an imaginary wealth. Its all about perception. In this system, being able to borrow money to buy real wealth is a privileges.

It's very simple... If you have a big head (high and stable income), don't wear a small hat, especially if everyone with lower income than you tries on a larger hat. The current pricing system is relatively stable and I think there won't be that huge fluctuation going forward, although the higher end housing will still face pressures.

If you have a small head (lower or relatively unstable income), go for something more practical (HDB or entry level private), or lay off committing until you have built up a larger sum for downpayment.

Right-sizing the head-to-hat ratio is very important for stability and growth in SG system. Else everyone tries to outborrow his neighbour, it will never end. And provides too much insecurity to most of the working middle class that their total annual income earned can't even match up to the growth in price in their desired housing. The right-sizing should continue till June 2017 (when TDSR refinancing concessions are totally removed, and depending on interest rates then, we can then re-assess the condition of our housing market (notwithstanding any other external shocks or concessions to the system).

The three laws of Kelonguni:

Where there is kelong, there is guni.

No kelong no guni.

More kelong = more guni.

“Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity.”

― Martin Luther King, Jr.

OUT WITH THE SHIT TRASH

https://www.facebook.com/shutdowntrs

“Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity.”

― Martin Luther King, Jr.

OUT WITH THE SHIT TRASH

https://www.facebook.com/shutdowntrs

The employer ability to honor the cheque in turn very much depend on the worker ever increasing job productivity. Once the productivity stalled, the boss bank account dwindle and his ability to honor the cheque is threaten.

Similar to US situation. The boss is trying to keep his company afloat by pushing his workers to be more productive. He is also paying less interest on the cheque.

His solvency is now depend on miraculous push for productivity and his workers trust on the value of his cheque.

“Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity.”

― Martin Luther King, Jr.

OUT WITH THE SHIT TRASH

https://www.facebook.com/shutdowntrs

yes.... the boss need to eat and live well to keep the grand illusion of solvency. The workers need to work hard to keep productivity ever higher. Everybody happy. The workers must not be too selfish as refusing to sell their blood and kidney for the sake of survival of the system.

That is why all country have "well educated" work force.

We shall know more after tonight.

Thank you all for shedding light by providing very well thought out annotates and reference links.I always advocate to spend within one's means and not to over leverage.

Would like to ask, what income bracket is considered as high income? is it more than 20k?

http://pragcap.com/understanding-quantitative-easing

There were lot of Tonight and all the Tonight look the same more money printing.

When I finally grasp the concept, this reference http://pragcap.com/mechanics-qe-transaction mentioned that no money printing is actually involved for QE. Its just an assert swap.

Ok..I am pretty confused right now...*cracks head*

Last edited by Yuki; 17-09-14 at 23:14.

The idea is to save up more before committing. Ensure that debts (cars, credits etc) are not overwhelming. Check that you have safety buffer funds. Down payment cannot be borrowed,

High or low income is all relative, more important is right-sizing debt to income, or else housing loans becomes just like Toto or 4-D tickets. Refer with your bank the TDSR ratio. I think if you can meet the TDSR to service your loan plus buffer of savings (depending on the nature of your income and your propensity for risk), you are good to go.

The three laws of Kelonguni:

Where there is kelong, there is guni.

No kelong no guni.

More kelong = more guni.