STI today above 3,100

HSI hot money flowing in ... 22,350

China-A finally found strong support below 2k

Dow consolidated above 13k

Gold consolidated above 1700

China property market chiong in Oct/Nov

Recent strong bids by developers for Bishan land

Ulu Punggol EC land bid at 350psf

Your friendly transport minister asks u to pay more for bus drivers

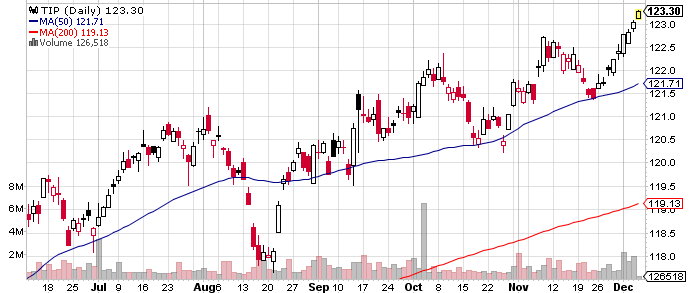

The Perfect Inflationary Storm is coming

Reply With Quote

Reply With Quote

Yee ha! Did I tickle your funny bone?

Yee ha! Did I tickle your funny bone?

and then change raw herbs to bus drivers

and then change raw herbs to bus drivers

Fed QE3 May Hit $1 Trillion as Fiscal Deadlock Persists

Fed QE3 May Hit $1 Trillion as Fiscal Deadlock Persists