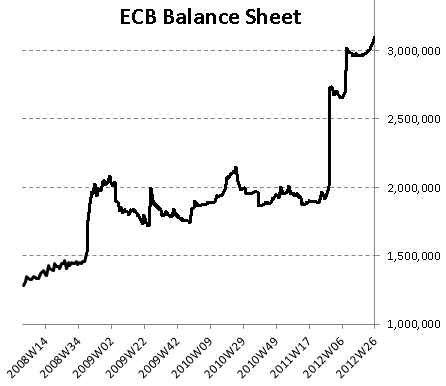

Central banks are nowadays acting more like fiat money value destroyer .... setting up this new thread to track

=

The US Fed's asset holdings in the week ended Oct. 17 climbed to $2.849 trillion, up from $2.813 trillion a week earlier, it said in a weekly report released Thursday.

The Fed's holdings of U.S. Treasury securities grew to $1.659 trillion on Wednesday from $1.654 trillion. The central bank's holdings of mortgage-backed securities rose to $862.30 billion from $835.01 billion a week ago

====

Reply With Quote

Reply With Quote