Hong Kong property market scaled new high in August

Hong Kong property market scaled new high in August

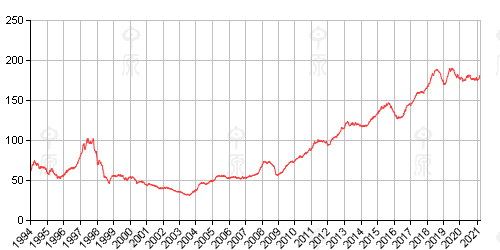

[Centa-City Leading Index]

106.54

Monday, August 06, 2012

Sentiment in the property market remains positive as investors seek out investments other than equities.

Over the weekend, home prices climbed to yet another all-time high as more apartments changed hands.

Centa-City Index, a benchmark for Hong Kong's secondary home prices, climbed to a record 106.54 in the last week of July.

"As market sentiment continued to heat up in the past couple of weeks ... transactions of mid- to high-priced flats increased significantly," said Ricacorp Properties executive director Willy Liu Wai-keung.

Highlighting the strong demand, a 433-square-foot flat at Tai Po Centre was sold within one hour of listing, according to Mark Fong, an assistant sales manager at Centaline Property Agency.

Ride at your own risk !!!

Reply With Quote

Reply With Quote