Business Times - 15 Sep 2011

Prospects for S'pore landed homes

ALAN CHEONG shares investment strategies for this property segment, which has seen larger price increases than non-landed homes

THE Singapore landed residential market will always be a hot topic of discussion for many, from homebuyers to developers and policymakers. But the big question for investors would be whether it still pays to take a bet on landed property today. The outlook for the landed home market has to encompass an analysis of the broader residential market as a whole. It would be appropriate to first look at the longer term drivers of the residential property market.

Income

A positive relationship exists between median income by housing type and the overall Urban Redevelopment Authority private property price index (URA PPI). Although the URA PPI increased more than median incomes last year, the market may not have strayed too far from fundamentals because while median incomes rose, average incomes rose even more.

In real estate (or other investment markets), when prices are moving up, it is frequently those in the upper income brackets who set benchmarks. Hence, while median and average income growth may lag property price increases, in a rising market, it is the top 10 per cent by income level of the population who determine new transaction prices.

Supply and demand

The supply for the entire private residential housing market, though high, is not too excessive. While the total supply, from 2011 to beyond 2015, numbers 87,242 units, if one were to subtract the units already sold, the number of unsold units is actually significantly lower. For 2012 to 2014, the units expected to be completed and currently unsold range from 2,299 to 9,329. This is significantly below the average new unit sales of about 12,000 from 2008 to 2010, although new supply is likely to be added from future government land sale sites.

Outlook

In our liquidity charged environment, the ebb and flow of funds would cause volatility in investment markets. While fundamentals point to a relatively balanced outlook for the private property sector, short-term changes in sentiment may affect landed property demand and prices.

Over the longer term, investing in landed properties has been rewarding as the following points show:

Outperformance in historical price performance over non-landed properties

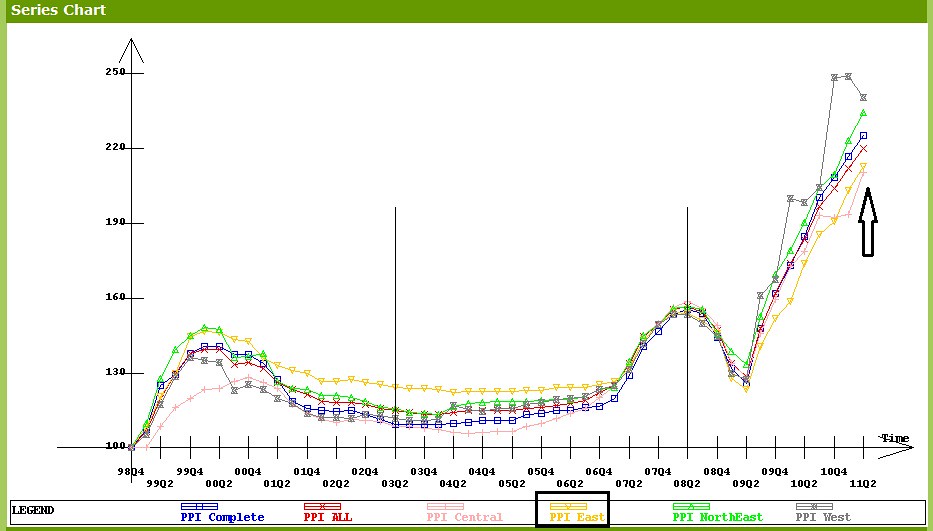

From 1990 to Q2 2011, landed property prices have risen at a compounded rate of 6.2 per cent per annum for terraces; 6.8 per cent per annum for semi-detached homes; 7.6 per cent per annum for detached homes; and 9.2 per cent per annum for Good Class Bungalows (GCBs).

As an investment, landed properties have performed better than condominiums and apartments, for which prices grew at 5.8 per cent per annum over the same period (see Figure 1).

From this perspective alone, it pays to be exposed to landed properties.

Limited supply

It is possible that the performance of landed properties will show a slight decoupling from that of non-landed properties, as the percentage of landed properties to total properties continues to fall further.

In Q1 2005, 30.2 per cent of the total private housing stock was landed properties. By Q2 2011, this fell to 26.6 per cent. Of the known future supply of private residential properties in the pipeline, only 4.6 per cent are landed properties. This will dilute the total landed stock to about 21.1 per cent. Given such dynamics, the relative scarcity factor may create a micro-economy within the landed property segment.

Expectations

Private residential property prices, especially those for landed properties, have proven to be more than a hedge against inflation over the years. While inflation grew by 1.84 per cent per annum from 2000 to June 2011, landed properties outperformed by a wide margin. If we were to go back to 1984, annual inflation has been 1.63 per cent per annum while prices of terrace, semi-detached and detached houses rose by 5.2 per cent, 5.4 per cent and 6.7 per cent respectively.

The superior long-term price performance of landed properties would have been seared into the minds of more than a generation of investors. It would not be easy to change that behaviour, even if markets take a severe hit for a few quarters.

In the short and medium term, there are other factors to consider.

Global events

The less than ideal pro-tem resolution of the US debt crisis, Standard & Poor's downgrade of the US's AAA-rating, potential contagion arising from European sovereign debt issues and China's slowing economy are matters that no doubt weigh heavily on the minds of investors. After all, the private residential real estate market has been affected more by external shocks than internal events.

If history is a guide, the short-term outlook for the landed residential market will be more dependent on what arises from the slew of sovereign debt related problems in the developed world. The jury is still out as to whether further monetary stimulus is in the offing (also known as QE3 or a variant of it) since government pump priming in the developed world is crimped by austerity measures.

However, given the deficits confronting Western governments, it is clear that government stimuli is probably going to be limited this time round. Thus, the only tool left is monetary policy. Should the system be flooded with another burst of liquidity, higher inflation may take root in the medium to longer term.

In a liquidity charged environment, residential prices may be subject to greater volatility, but as property is a hedge against inflation, it should benefit from higher inflationary expectations.

Domestic policy intervention

Domestic policies curbing real estate speculation have had either no historical precedence in bringing down private landed properties prices or the effect is unclear, being clouded by external events just after they were introduced. For example, the May 1996 anti-speculation measures had a mixed effect on various housing types and the end result was unclear because the Asian financial crisis happened not long after its introduction.

Investment strategy

Figure 2 shows the price sensitivity of the various landed housing types to the overall URA PPI. The percentages on the y-axis mean that for terraces, a one per cent rise or fall in the URA PPI would lead to a 0.92 per cent rise or fall in the prices for terraces. For GCBs, the sensitivity is greatest with a one per cent change in the URA PPI leading to a 2.22 per cent change in the price of GCBs.

This price sensitivity has implications for different groups of investors. For an investor who does not want to time the market, but wants to gain exposure to the landed property market, buying terraces would allow him some downside protection should the market suffer negatively from the recent spate of global events. That investor would, however, still benefit from long-term price appreciation - an annualised 6.2 per cent compounded growth rate from 1990 to Q2 2011 - higher than the 5.8 per cent for apartments and condominiums.

Buying detached homes, and especially GCBs, gives the highest returns. And if one were to time the market, returns would be even greater. However, this means that if the investor is wrong about the duration and severity of a downturn, he can be penalised because a one per cent decline in the URA PPI should similarly lead to a 1.2 per cent and 2.2 per cent fall in overall detached and GCB prices. Should the investor time the investment right, the rewards will match the risks.

The writer is associate director of Savills Research & Consultancy

Reply With Quote

Reply With Quote